Packaging Universe

There are constellations of expertise, planets of materials, technological orbits and creative paths to explore packaging in all its dimensions. Aesthetics and function, sustainability and storytelling, technological innovation and craftsmanship coexist in this universe. And it is so vast that it is not easy to map its boundaries. Here, we tell you about some of the different interconnected worlds that interact and influence each other, as well as market and design trends, and a selection of the best applications.

by The Editorial Staff | On PRINTlovers 106

LUXURY

In 2024, the Italian luxury goods market was estimated at $21.06 billion, with growth driven mainly by tourism and international demand. Globally, the luxury packaging sector reached a value of $17.5 billion in 2024, with growth forecasts of up to $24.6 billion by 2033, at a compound annual growth rate of 3.82%. (Mordor Intelligence).

Defining luxury in paper packaging involves combining aesthetics, function and brand identity. It is not just a question of materials or finishes, but of sensory experience and communicative consistency. For this reason, the design of a high-end pack requires a tailor-made approach, based on detailed briefings, collaboration between creatives and technicians, and an assessment from the earliest stages of feasibility and industrial optimisation.

The application sectors of luxury packaging in Italy

Luxury packaging is now a strategic asset for many industrial sectors, especially in a country like Italy, where manufacturing excellence and perceived brand value are key elements of competitiveness. The main sectors are:

by The Editorial Staff | On PRINTlovers 106

LUXURY

In 2024, the Italian luxury goods market was estimated at $21.06 billion, with growth driven mainly by tourism and international demand. Globally, the luxury packaging sector reached a value of $17.5 billion in 2024, with growth forecasts of up to $24.6 billion by 2033, at a compound annual growth rate of 3.82%. (Mordor Intelligence).

Defining luxury in paper packaging involves combining aesthetics, function and brand identity. It is not just a question of materials or finishes, but of sensory experience and communicative consistency. For this reason, the design of a high-end pack requires a tailor-made approach, based on detailed briefings, collaboration between creatives and technicians, and an assessment from the earliest stages of feasibility and industrial optimisation.

The application sectors of luxury packaging in Italy

Luxury packaging is now a strategic asset for many industrial sectors, especially in a country like Italy, where manufacturing excellence and perceived brand value are key elements of competitiveness. The main sectors are:

- Fashion, accessories and personal luxury, where packaging is an integral part of the brand experience, from rigid boxes to paper shopping bags that characterise the in-store shopping experience.

- Cosmetics and perfumes, which are a €16 billion industry as of 2024, with €7.4 billion coming from exports. Packaging plays a crucial role in this sector and is often characterised by extensive formal research combined with a focus on sustainability.

- Jewellery, watches and precious objects: in this segment, packaging is not just a container but a case that prolongs the luxury experience.

- Wine & Spirits: here, packaging tells the story of origin, craftsmanship and authenticity. The distinctive elements include boxes, rigid cases, customised bottles, fine woods, and natural papers.

- High-end electronics and corporate gifts: even high-end electronics use minimalist and sophisticated packaging to express value and innovation. In corporate gifting, luxury packaging has become an ally in strengthening the brand image. According to Verified Market Reports, the global luxury gift packaging market will grow from $20.5 billion in 2022 to $29.5 billion in 2030, driven in part by growth in B2B demand.

Distinctive materials and techniques

The use of fine papers, craftsmanship and extensive customisation characterises luxury solutions. Special Pantone colours, embossing, soft-touch coatings and complex finishes are frequently chosen. Perfect execution is essential: zero defects, flawless finishes and durability are must-have parameters. The cost reflects a tailor-made design process, which is often complex and highly specialised.

New forms of luxury

The sector is evolving to embrace more sustainable types and rationalised constructions. While linear cases and rigid boxes for cosmetics and wine & spirits remain strong, simplified models with innovative geometric structures and mixed materials are emerging. Adding technological components such as LEDs, invisible magnets, or automatic openings enriches the experiential value without compromising functionality.

Interior fittings and functional protection

The internal organisation of the packaging also measures luxury. The most advanced solutions replace plastic with single-material structures in shaped or micro-pressed cardboard, guaranteeing protection and aesthetic consistency and improving the environmental profile. The focus on functionality also extends to post-sale use: some packaging becomes display units or glorifiers, extending its life cycle.

Sustainability and design intelligence

Environmental sustainability is reshaping the industry's priorities. Companies are focusing on recyclable paper, compostable materials and low-impact printing techniques. The elimination of plastics and glues, design for disassembly, and use of natural or recycled substrates are now standard in the most advanced projects. The concept of luxury focuses on design intelligence: it is enriched with a new ethical dimension, without sacrificing quality or perceived value.

FOOD & BEVERAGE

In the food and beverage sector, packaging is undergoing a profound transformation. It is focused on balancing functional performance, reduced environmental impact, and logistics optimisation. The projects awarded at the WorldStar Global Packaging Awards 2025 clearly outline the most advanced development trends.

Single-material barriers and full-paper solutions

One of the most significant developments is the adoption of single-layer materials, in particular PE, PP, and paper with functional coatings. These barrier films protect from oxygen and moisture, extending the shelf life of sensitive products such as dairy products and snacks while remaining compatible with existing packaging lines. At the same time, full-paper solutions are growing: moulded or laminated containers with compostable coatings suitable for direct contact with solid or liquid foods, offering a concrete alternative to using mixed materials, which are difficult to recycle.

Active packaging and smart preservation

Packaging that interacts with the contents, actively influencing preservation, is also becoming more widespread. This is the case with trays made from recycled material with antibacterial properties or packaging equipped with systems capable of absorbing moisture or releasing inert gases. These technologies, applied to fresh, ready-to-eat or biologically active products, effectively reduce food waste and extend the commercial life of products.

Flexible formats and refill systems for food

The refill concept, already well established in other areas, is also extending to food. Doypack pouches or flexible single-material PE bags with dispenser caps are replacing rigid containers for sauces, condiments and vegetable drinks. Lightweight, compressible and compatible with mechanical recycling, these solutions improve logistics density and reduce weight per packaged unit, promoting sustainability throughout the sector.

Ergonomics and on-the-go consumption

Packaging designed for direct consumption meets the need for practicality and functionality. Trays divided into multiple compartments, high-seal resealable closures, effortlessly removable films, and integrated accessories, such as paper cutlery or lids that can be transformed into plates, characterise the solutions designed for ready meals and snacks. Using technologies such as barrier thermoforming and flexographic printing on compostable substrates allows for advanced design, also for the vending channel or use in microwaves.

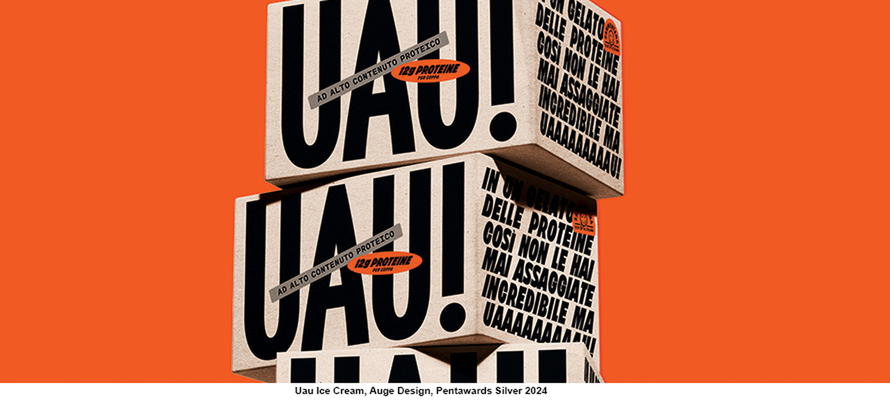

Pasta, healthy food and treats

The Pentawards, on the other hand, give us an idea of how technological research is combining with design to develop effective and innovative brand communication. Among the main trends identified in the projects awarded in the latest edition, the redesign of the Italian product par excellence, pasta, stands out, with a refined aesthetic that redefines the identity of historic brands such as Voiello, Agnesi and Barilla, positioning them in the gourmet food segment thanks to limited editions and gift packs. Pop aesthetics, colourful and with large characters, for more niche and local pasta brands such as Pasta Luciano, but also for plant-based and healthy products. There is also great freedom of experimentation in the confectionery and gourmet sectors, which leave ample scope for sophisticated solutions in the choice of materials and finishes.

BEAUTY

Sustainability, efficiency and user experience are the keywords for packaging in the beauty and personal care sector. In 2024, the packaging sector in this segment in Italy recorded significant growth, with a domestic market value of over €12.5 billion (+9.4% compared to 2023), according to the 2024 Annual Report by Cosmetica Italia. Exports now account for 46% of production and have passed €7 billion, confirming the sector's international competitiveness.

The importance of skincare

The skincare segment is one of the most dynamic and growing: products (serums, creams, masks, cleansers) require primary packaging that preserves the stability of active formulas, which is why airless and single-dose solutions are increasingly emerging.

Refillable solutions and smart dosing systems

Refillable packaging with advanced dosing systems is gaining ground. These designs allow for precise product dispensing, reducing waste and improving the user experience.

Rethinking materials

Plastic remains the primary material for beauty and personal care packaging, with a market share of over 45.5% in 2024. Formats such as bottles, jars, tubes and caps mainly use PET, HDPE and PP, thanks to their lightness, versatility and convenience. However, the segment is transforming: the use of biodegradable plastics and PCR (post-consumer recycled) materials is growing, but significant challenges remain in terms of costs and regulations for advanced recycling technologies. An interesting innovation is 100% paper packaging for liquid products, which eliminates the use of plastic while maintaining the integrity and safety of the contents. Glass continues to be the preferred material for the luxury segment due to its aesthetic and protective qualities, while aluminium is valued for its strength and barrier properties against light and oxygen. FSC or recycled cardboard dominates secondary packaging, chosen for its low environmental impact.

Minimalist and functional design

Minimalism in design translates into elegant packaging that optimises the use of materials and improves functionality. The focus is on aesthetically pleasing and practical solutions that facilitate everyday use and recycling. Finishes—screen printing, engraving, metallisation, soft touch—remain fundamental to the premium nature of the product.

PHARMA

Pharmaceutical packaging is highly technical and regulated: it must protect, preserve, dispense and inform. Proper design can directly influence adherence to therapy. Legislative Decree 219/2006 distinguishes between primary packaging (in direct contact with the medicine), secondary packaging (blister pack, label, package leaflet) and tertiary packaging (logistics). Specifically, primary packaging includes plastic, glass and aluminium containers, blister packs, and single-dose sachets, with aluminium blister packs accounting for over half of the segment. FBB cardboard boxes are the standard for secondary packaging, which is used to highlight the differences between prescription and OTC drugs. Legibility, ergonomics and compliance with graphic regulations (including adhesive labels) are essential.

In 2025, packaging for the pharmaceutical sector confirms a clear trajectory: sustainability, safety, and digitalisation are the three axes on which innovation is played out. The projects awarded at the WPO (World Packaging Organisation) WorldStar Global Packaging Awards 2025 demonstrate this, confirming pharmaceutical packaging as a valuable reference point for other sectors seeking efficiency and environmental responsibility.

Monomaterials and real recyclability

The search for alternatives to composite materials is translating into solutions based on high-barrier monomaterials designed to ensure maximum recyclability. Some award-winning pharmaceutical blister packs use fully recyclable polypropylene films, drastically reducing environmental impact while maintaining high protection standards for active ingredients.

Moulded cellulose fibres for primary packaging

Moulded fibre, which was mainly used for secondary packaging until a few years ago, is now moving into primary packaging. Rigid containers with screw caps made of pressed cellulose are becoming viable alternatives to plastic bottles for solid oral products, supplements and medical cosmetics, combining natural aesthetics, functionality and compatibility with paper collection.

Intelligent protection against UV radiation

Another key area is the protection of photosensitive drugs. New generations of blister packs offer integrated barriers against moisture, oxygen and UV rays, without the need for opaque outer packaging or additional materials. This is not only an environmental advantage but also simplifies logistics.

Advanced anti-counterfeiting systems

In security, award-winning solutions focus on systems that combine visible tamper evidence and invisible or digital traceability codes. These systems make tampering more difficult and allow authenticity to be checked throughout the supply chain.

Augmented reality at the service of therapeutic adherence

Finally, digital technology is also making a strong entry into primary packaging by adding augmented reality content. QR codes applied to packaging and devices activate video tutorials and interactive instructions accessible from smartphones, to improve understanding of therapies and reduce administration errors.

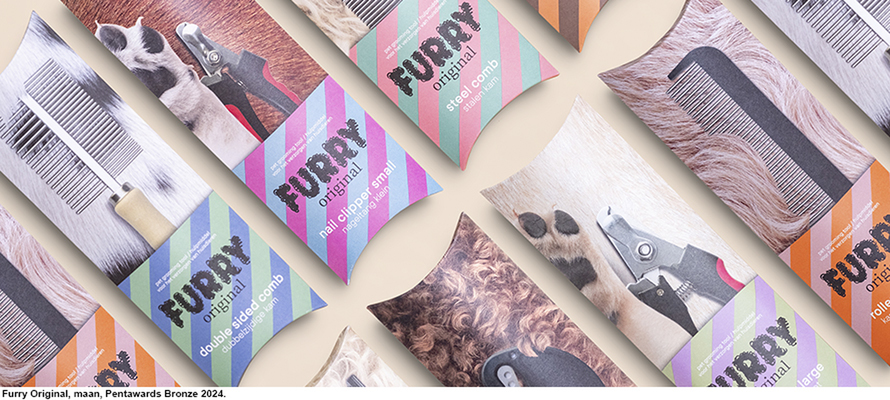

PETS

The pet food and accessories market is booming in Italy and globally, driven by profound changes in the relationship between humans and pets and a greater focus on sustainability. According to Eurispes, there are 53 pets per 100 inhabitants in Italy, with a national turnover in the pet care sector exceeding €2 billion. Globally, the pet food market grew from $59.3 billion to $123.6 billion in just one year, showing significant growth. In terms of food, there is an increasing demand for products with natural ingredients, no allergens, and that are enriched with superfoods. Sixty per cent of pet owners prefer recyclable and sustainable packaging products, reflecting a growing environmental awareness.

Emotional design, practicality and transparency

Design trends in this sector focus on three pillars: emotional design, in which packaging uses illustrations, mascots, bright colours and striking lettering to create an emotional connection with the consumer; functionality, which involves the use of resealable packaging and durable materials to improve preservation and ease of use; and transparent communication, with clear information highlighting ingredients, nutritional benefits and any certifications. But pet food is not everything: a significant part of spending goes not only on veterinary care, but also on cosmetics, accessories and furnishings for animals, all products with packaging that draws on different sectors while maintaining the emotional style of pet food.

TECH

In 2024, the Italian consumer technology market recorded a turnover of €16.2 billion, a slight decline of 0.6% compared to the previous year. Smartphones and tablets accounted for around 27% of the market, driving demand for compact, protective, sustainable and smart packaging. Frequent sales and rapid technological updates make these devices the main drivers of innovation in electronic packaging. Globally, the consumer electronics packaging market was valued at $26.2 billion in 2023 and is expected to grow at a compound annual rate of over 18.4% between 2024 and 2032 (Global Market Insights data).

Protection and sustainability

Sustainability is a key driver of this expansion, with companies investing in eco-friendly packaging solutions to meet consumer expectations and environmental regulations, combining sustainability with product protection, especially in light of the rise of e-commerce, which accounted for 45% of the market in 2023. Minimalist design, partly due to the choice of materials such as corrugated cardboard and kraft paper, continues to be a popular choice, with an emphasis on bold typography and neutral colour palettes. This approach gives packaging a modern and sophisticated look and facilitates recycling by reducing unnecessary inks and materials. Customisation and the addition of solutions for smart and connected packaging are also significant.

E-COMMERCE

As volumes grow, so do expectations. E-commerce packaging remains one of the industry's most dynamic and strategic segments, evolving to reflect not only the exponential growth of online commerce but also a new packaging culture focused on performance, brand identity, and sustainability.

Function, form and supply chain: the most commonly used types

In e-commerce, packaging must meet complex requirements: protect during transport, communicate the brand, and optimise space and costs. The most popular formats confirm this multifunctionality: corrugated cardboard boxes, often customised to improve the unboxing experience; padded envelopes for fragile or small items; flexible envelopes and polybags, widely used in fashion retail; and customised packaging designed to optimise volumes and reduce materials. Customised solutions, in particular, are gaining ground due to their ability to combine logistical efficiency and branding.

The rise of sustainable materials

With the growing rejection of single-use plastics and an increasing focus on environmental regulations, companies in the sector are rethinking materials: corrugated cardboard and kraft paper remain the most popular choices; compostable, recyclable or 100% biodegradable options are multiplying; additives in virgin plastics, which hinder recycling or pose health risks, are subject to increasing restrictions. Despite these trends, in 2023, the industry had to deal with a 5.6% contraction in paper-based packaging production (WorldStar, 2025), thus accelerating the need for even more efficient and lightweight solutions.

Printing? Digital, smart, customised

Printing technology is following the trend towards adaptability. Offset remains the leading choice for large print runs, but digital printing is increasingly popular for limited edition packaging and mass customisation. QR codes, NFC, RFID, and digital interfaces make packaging an active touchpoint, which is also helpful for traceability and post-sales interaction.

Packaging makes the difference between shipping and retaining customers

In 2025, e-commerce packaging design must respond to a clear brief: be simple, sustainable and memorable. The main aesthetic and functional trends include: structural minimalism, to facilitate disposal and reduce costs; experiential unboxing, where form and decoration help strengthen the relationship with the brand; narrative packaging, which communicates the story of the product or company; digital interactivity, to integrate content, guides or personalised promotions.

SMART PACKAGING

There was a time when packaging was just a wrapper. Then it became a brand storyteller, a guarantor of sustainability, a catalyst for experiences. Today, it is all this and more: packaging has become smart. We are talking about a profound transformation, where technology and design combine to shape intelligent solutions capable of communicating, interacting and measuring. In a market increasingly oriented towards personalisation and traceability, smart packaging is revolutionising how brands tell their stories and relate to consumers. Dynamic QR codes, NFC, RFID, environmental sensors and smart tags are just some of the technologies that enable packaging to talk to those who touch or scan it. Smart packaging can tell the story of a product, authenticate a garment, offer exclusive content, indicate when a cosmetic has been opened or if a food product has been stored correctly. And in doing so, it creates a bridge between the physical and digital worlds, between branding and experience.

Technology, yes, but at the service of storytelling

The risk, however, is that technology becomes an end in itself, a gadget that distracts from the content. The real value lies in the addition of form, function and storytelling. In this sense, smart packaging does not replace creativity, it amplifies it. A QR code can be the beginning of an immersive story; an NFC tag, the key to a digital world tailored to the consumer. It is not just about impressing, but about giving meaning. Smart packaging can enhance the sector’s transparency, promote loyalty and guide purchasing decisions. It can do so with consistent visual languages, accessible interfaces, and engaging experiences.

Smart is also sustainable

Sustainability remains a central issue. While smart packaging opens up new opportunities for reducing waste, for example, by monitoring the freshness of food, it also raises questions about the environmental impact of electronic devices and composite materials. But here too, innovation makes the difference: labels printed with conductive inks, biodegradable RFIDs and miniaturised chips that can be integrated into paper and cardboard are opening up scenarios that are increasingly compatible with the needs of the circular economy.

Towards connected design

Smart packaging is not just a technical challenge but a systemic design matter. It requires strategic vision, interdisciplinary skills and a new design sensibility. It is a field where engineering, communication, user experience and sector innovation come together. For brands and creatives, it is an opportunity to rethink the very role of packaging: no longer a simple support, but an active hub of the product-communication-market ecosystem. Connected packaging that is capable of listening, responding and evolving. The future has already begun. And it passes through the hands of those who design tomorrow's experiences today.