Packaging: the magnificent three

Flexible, corrugated cardboard and paperboard cartons are the three most popular options in the world of packaging, as they meet the packaging needs of major consumer products, from food to pharmaceuticals to cosmetics. We take stock of technological advances, materials and printing techniques in these three significant and critical application areas.

By Roberta Ragona | On PRINTLovers 100

The push for a material-conscious approach goes back a long way, but many of these issues began to find more space in production choices, brand policies and legislative frameworks between the end of the 1990s and the first decade of the 2000s, up to the present day. This drive has stimulated technological advances and allowed brands and manufacturers to explore new possibilities in packaging. Let's see together, with the help of data and insights gathered by GIFLEX (GIFCO - Gruppo Imballaggio Flessibile - and GIFASP - Gruppo Italiano Fabbricanti Astucci e Scatatatelle Pieghevoli), what have been the innovations, the developments in the sector and in design that have affected three fundamental areas of product packaging.

Flexible and versatile

The world market for flexible packaging in 2022 was worth around $106 billion, with the United States and Asia ranking first and second in percentage importance. According to research carried out in Great Britain on the European market and published by Euromonitor/FPE, excluding beverages, flexible packaging in 2021 was the largest share of retail packaging in Europe. In Italy, flexible packaging accounts for a total turnover of 3.5 billion, corresponding to an estimated volume of around 421,000 tonnes.

Flexible is the youngest packaging type in terms of materials and technology and is in an expansion phase. The most important sector is food, in particular the fresh food area. Consumer demand for so-called convenience food (products requiring minimal processing, suitable for lunch breaks away from home or for those with little time or expertise in the kitchen) has driven its evolution, particularly with the arrival of pre-washed fruit and vegetables ready for consumption. The use of flexible packaging has expanded the consumption of fresh produce to a broader range of consumers: preserving its characteristics and slowing down spoilage has made it possible to make groceries last longer and limit waste.

The available formats are countless: some of the main ones are sachet, bag, clip or ponytail bag, flow bag, pouch, Doypack, and Cheerpack. Each is available in different variants, but the pouches have shown the most dynamic growth in recent years, with stand-up pouches in wet pet food and flexible bags for baby food. Significantly broadening the range of possible uses has been the arrival of zip and press pouches: from single-use packs to be consumed within a short time of opening, we have moved on to products to be stored in an open-and-close pack. The possibility of transparent packaging has an essential psychological function in reassuring the consumer.

Keeping product characteristics intact is also crucial in the health, personal and home care sectors. 20% of flexible packaging production is divided between pharma, pet food, hygiene and home. In cosmetics, single-dose packs are in great demand, while in homecare, refills have established themselves, intending to reduce rigid plastic containers.

Much of the flexible packaging is produced by co-extrusion or lamination techniques, where each layer performs a specific function. Currently, the push is towards mono-material, but multi-material remains the most effective choice for some uses. On the printing side, the most popular techniques depend on the required print run volumes and end-use. In large volumes, rotogravure printing has its relevance; in the face of longer makeready times on large numbers, it has an advantageous cost per item, with consistent print quality even on large numbers. At the same time, flexo printing is one of the most common methods.

Digital printing is a method that guarantees adaptability, thanks to the possibility of printing a small number of items with low minimum order quantities. In particular, techniques with low migration inks and LED drying enable shorter production and delivery times. The dot accuracy and high degree of detail achieved in recent years also makes it suitable for talking packaging. In recent years, the offering of 'active packaging' has increasingly expanded, in which, in addition to the passive barrier effect, active functionalities are added, such as antibacterial and anti-microbial films or layers capable of absorbing odours or moisture.

On the sustainability front, the quest to lighten materials while keeping performance intact has affected end-of-life techniques and recovery. Life Cycle Assessment studies show that lightweight and compact packaging helps optimise loading space and reduce transport impact and emissions for the same quantity of goods.

Research and development in recent years has focused on single-material packaging, which is easier to recycle and requires less processing to get back into circulation. Today, 70% of flexible packaging is recyclable, but the crux is the transition from recyclable to recycled. Many plants are designed to dispose of rigid plastics and only sometimes have the technology to separate multilayers. Part of the research is focusing on the production of odourless and colourless recycled polypropylene, and part on research into neo-materials and biodegradable and/or compostable plastics, including composites. The coupling of paper and biodegradable or compostable plastics is becoming increasingly common, particularly for pasta and bakery products. Currently, based on data from the Istituto Italiano Imballaggio, out of 63,000 tonnes of flexible packaging, the component made by coupling biodegradable and/or compostable materials is about 6.5%.

Cutting-edge corrugated cardboard

Corrugated board is a widely consumed material with a long history. Technological innovations over the past decade have expanded its areas of use into unexpected sectors such as interior design and fittings. According to data compiled in 2022 by Grand View Research, the global corrugated board market is worth more than $134 billion, with an expected growth rate between 2023 and 2030 of 6% per year. The spread of e-commerce and the demand for sustainable packaging will drive this growth. On the European market, the numbers are similarly encouraging: 4.8% up driven by food and beverage, in particular by fast-moving consumer goods (FMCG), in other words, products with a fast shelf life due to high demand - as in the case of soft drinks or snacks - or because they are in the fresh area. The corrugated board industry in Italy consists of more than 50 integrated companies and about 300 processors. It is the second largest producing country in Europe, after Germany. The production recorded in 2022 is about 8 billion square metres from 70 plants nationwide. The most significant area is tertiary transport packaging, particularly for the food sector, with 'processed food products' absorbing 60.5% of production. Non-food as a whole - furniture, cosmetics, construction, household appliances, pharmaceuticals, industry, personal hygiene and household cleaning - accounts for the remaining 39.5%. In particular, the pharmaceutical sector is seen as one of the markets that will grow the most in the coming years.

Corrugated board owes its mechanical strength and lightness to its construction. In its simplest form - two layers of flat paper (covers or liners) held together by a layer of corrugated paper (or wave) using natural glue - it has been in continuous use since 1857. With the different arrangement of these elements, various types are obtained. Several layers can be superimposed, double or triple-corrugated, or evenly divided by a stretched sheet for greater strength. Triple-wave board is strong enough to replace wood in some cases but weighs considerably less. The choice of paper also produces a different end product. The most common types are kraft paper (strong, made from virgin conifer pulp with 10%-20% quality recovered pulp), liner and test (papers made from selected recovered pulp and consisting of one or more layers).

The other variable is the type of corrugation applied. The reels of paper are loaded into a corrugating machine, which uses high-pressure steam and pressing to shape them. The waves can have different heights and pitches and vary in the number of waves per linear metre and the corrugation coefficient. The high wave has the best resistance to vertical compression but lower printability because the covers have a reduced flatness; the low wave is more resistant to flat compression, while the medium wave provides a compromise between performance and paper consumption, with good printability and higher resistance to stress during converting, packaging and shipping. The micro wave is mainly used in combination: the most popular format is the mini-triple, which provides excellent printability and is also used in the production of cartons. In addition to the specifications decided at the assembly stage, the board is classified according to its compressive strength, burst strength, water absorption ability and flexibility. Thanks to its versatility and advances in production and printing technology, various types of convertible corrugated packaging are now suitable for transport and product explanation. They are particularly aimed at the retail trade, simplifying loading-unloading and set-up operations with significant time savings.

Flexographic printing (flexo) is the most widely used technique for printing corrugated board. It is a direct printing technique: ink from the tray is deposited directly onto the substrate via the inking cylinder (cliché). The advantages of this technique are its low production cost and high quality. Screen printing is also still widely used, and among its advantages is the possibility of working on large formats, both with spot and 4-colour.

In corrugated board, digital printing has also gained several areas of use. It uses a process to imprint ink onto the substrate without using stencils and plates; with this technique, the ink is not absorbed directly but forms a layer fixed with a finishing. Digital printing allows a high-quality output, and because it does not have the costs of fixed installations, it can be used for short runs. When finishing, it is possible to make the surface of the carton glossy or matt with a lamination process, which is particularly suitable for displays.

One of the most exciting innovations in recent times is the progressive lightening of packaging, made possible by the technological evolution of converting machines and the offering of increasingly high-performance papers. The average weight of corrugated board has fallen steadily since 2000; the average in 2022 is 535 g/sq m. It is estimated to have saved 559,000 tonnes of raw material in 20 years. Also on the production front, research is focused on energy savings, with less energy-intensive processes and machines, and the reduced use of water in the production phase.

On the sustainability front, corrugated board is undoubtedly one of the materials in which substantial progress has already been made, starting with the raw material, which comes almost exclusively from certified forests. Italy is the leading European country in the virtuous management of post-consumer material: according to Comieco's 27th Annual Report of July 2022, 91.4% of paper and cardboard packaging is sent for recovery in our country and 85.1% in the recycling sector. Corrugated cardboard is a material in which recovery has reached significant peaks: 80% of corrugated cardboard for packaging is composed of fibre from pulp.

Folding carton: functional and elegant

In the Italian market, folding carton packaging represents 15% of the cellulose packaging sector. The average turnover of the folding cartons and boxes sector is up +9.9%, with a growth trend over the last ten years higher than the rest of the manufacturing industry, apart from a setback in 2021. It is a counter-cyclical sector, less sensitive to negative cycles.

Production in 2022 is expected to be around 868,000 tonnes. It is predominantly used as secondary packaging, and the target sectors are 44.2% food, 19.2% beverages and 9.2% cosmetics and pharmaceuticals. The remaining 27.3% is grouped under 'non-food' within which are categories such as small household appliances that do not require corrugated packaging, kitchen utensils, household products, furniture accessories, and much more. The cosmetics sector was the most dynamic in 2021, growing by +18.4%, while pharmaceuticals grew by +4.2%. The self-assembling carton is one of the cases where the role of the silent brand ambassador is most versatile and effective. It is a format that moulds itself to the tone of voice of the product: functional, clear and reassuring in pharmaceuticals, refined and aspirational in cosmetics, and engaging and communicative in food and beverage.

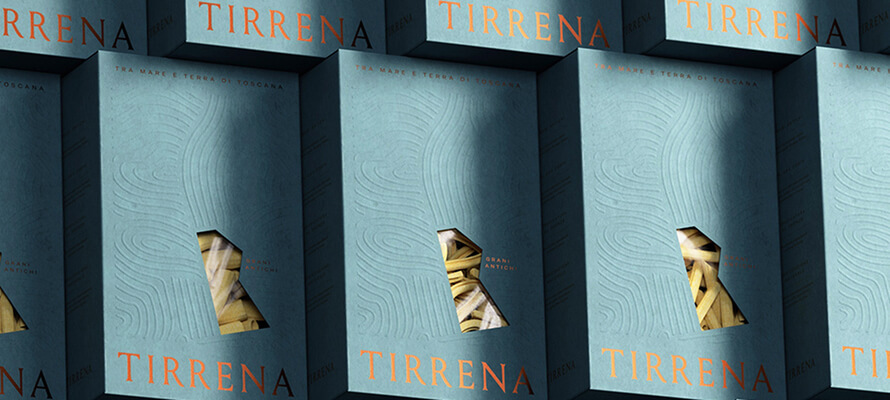

The cardboard or folding carton is easy to process, and the different types of surface - coated, matt, embossed, bleached or coloured paste - allow endless graphic and paperboard design possibilities. They can be made of 100 per cent folding carton of different grammages and processes, or composite, depending on the end use. The most common combinations are with PE or aluminium film, which is increasingly replaced by layers subjected to metallisation processes. The combination with a plastic or aluminium film may have functional or aesthetic reasons, such as for packaging used in the cosmetics sector. The strength of cartons is their incredible versatility: matt or glossy printing effects, metallised and textured varnishes for a 3D effect, embossing, and letterpress turn packaging into a sensory experience involving both sight and touch through texture and combinations. The possibility of inserting openings, windows, cuts and half-cuts using die-cutting or laser cutting gives the product greater visibility and variety to the packaging design. The development of laser die-cutting technology has made it possible to integrate this phase inline during printing.

Cardboard is a valuable substrate that lends itself to various aesthetic embellishment techniques without sacrificing functionality through different application lines of lamination with metallic, pastel, glossy/opaque, gold, silver, and hologram effects and through the cold foil or hot stamping process. It is an ideal substrate for gloss and matt screen-printing finishing techniques and glitter and pearlescent UV varnishes.

Printing with high-resolution offset technology that can come into direct contact with products or foodstuffs has also made it a popular type of packaging in the catering industry. With its lower impact on both production and disposal, it is increasingly replacing packaging made of other materials designed to come into contact with food-type products. Also, in the case of cartons, the offering of active packaging that is not limited to the barrier effect is being enriched with advanced functions, such as anti-odour or anti-oxidation layers designed to preserve the integrity of articles better. Among the most popular developments are those relating to coatings and barriers not only to odours but also to grease and moisture. The most exciting innovation is the possibility in recent years to achieve this through cellulose fibre-only barriers (MFC), which significantly facilitates the recycling phase.

Innovation has also involved machinery, which has become more sophisticated over the last few years to be able to process ever-thinner materials in a trend towards lighter paper but with equivalent performance that can optimise costs and environmental impact. Currently, the structural limit of cardboard for product packaging and protection is around 700-800 g/sq m, but this crucial technological advancement has allowed a weight reduction of up to 30%. Improvements in production have been accompanied by continuous research by paper manufacturers to introduce improvements in the choice of additives and the mix between virgin cellulose and waste paper in their range.

The same applies to the varnish and ink sector, with the creation of low-odour and low-migration inks and varnishes and limiting plastic films' use to embellish cartons, boxes and shoppers, replaced by equally high-performance finishing. Using inline cold foil technology in offset printing has made it possible to eliminate metallised plastic films and reduce costs.

A final important innovation concerns safety, with paper solutions with openings designed to prevent an unsupervised child from accidentally opening the carton. These systems are particularly useful in the pharmaceutical and detergent sectors. But the pack finishes are not just aesthetic: embossing allows for 3D effects that make the packaging speak in an accessible way through the use of Braille.

On the sustainability front, all the steps forward in the lightening of the material, in the adoption of finishing and barrier layers that can replace multi-material laminations in many cases have made an essential contribution to reducing the impact of these packaging formats, but another vital feature is the recyclability of the paperboard. Paperboard fibre can be reused up to 25 times, becoming a secondary fibrous material.

By Roberta Ragona | On PRINTLovers 100

The push for a material-conscious approach goes back a long way, but many of these issues began to find more space in production choices, brand policies and legislative frameworks between the end of the 1990s and the first decade of the 2000s, up to the present day. This drive has stimulated technological advances and allowed brands and manufacturers to explore new possibilities in packaging. Let's see together, with the help of data and insights gathered by GIFLEX (GIFCO - Gruppo Imballaggio Flessibile - and GIFASP - Gruppo Italiano Fabbricanti Astucci e Scatatatelle Pieghevoli), what have been the innovations, the developments in the sector and in design that have affected three fundamental areas of product packaging.

Flexible and versatile

The world market for flexible packaging in 2022 was worth around $106 billion, with the United States and Asia ranking first and second in percentage importance. According to research carried out in Great Britain on the European market and published by Euromonitor/FPE, excluding beverages, flexible packaging in 2021 was the largest share of retail packaging in Europe. In Italy, flexible packaging accounts for a total turnover of 3.5 billion, corresponding to an estimated volume of around 421,000 tonnes.

Flexible is the youngest packaging type in terms of materials and technology and is in an expansion phase. The most important sector is food, in particular the fresh food area. Consumer demand for so-called convenience food (products requiring minimal processing, suitable for lunch breaks away from home or for those with little time or expertise in the kitchen) has driven its evolution, particularly with the arrival of pre-washed fruit and vegetables ready for consumption. The use of flexible packaging has expanded the consumption of fresh produce to a broader range of consumers: preserving its characteristics and slowing down spoilage has made it possible to make groceries last longer and limit waste.

The available formats are countless: some of the main ones are sachet, bag, clip or ponytail bag, flow bag, pouch, Doypack, and Cheerpack. Each is available in different variants, but the pouches have shown the most dynamic growth in recent years, with stand-up pouches in wet pet food and flexible bags for baby food. Significantly broadening the range of possible uses has been the arrival of zip and press pouches: from single-use packs to be consumed within a short time of opening, we have moved on to products to be stored in an open-and-close pack. The possibility of transparent packaging has an essential psychological function in reassuring the consumer.

Keeping product characteristics intact is also crucial in the health, personal and home care sectors. 20% of flexible packaging production is divided between pharma, pet food, hygiene and home. In cosmetics, single-dose packs are in great demand, while in homecare, refills have established themselves, intending to reduce rigid plastic containers.

Much of the flexible packaging is produced by co-extrusion or lamination techniques, where each layer performs a specific function. Currently, the push is towards mono-material, but multi-material remains the most effective choice for some uses. On the printing side, the most popular techniques depend on the required print run volumes and end-use. In large volumes, rotogravure printing has its relevance; in the face of longer makeready times on large numbers, it has an advantageous cost per item, with consistent print quality even on large numbers. At the same time, flexo printing is one of the most common methods.

Digital printing is a method that guarantees adaptability, thanks to the possibility of printing a small number of items with low minimum order quantities. In particular, techniques with low migration inks and LED drying enable shorter production and delivery times. The dot accuracy and high degree of detail achieved in recent years also makes it suitable for talking packaging. In recent years, the offering of 'active packaging' has increasingly expanded, in which, in addition to the passive barrier effect, active functionalities are added, such as antibacterial and anti-microbial films or layers capable of absorbing odours or moisture.

On the sustainability front, the quest to lighten materials while keeping performance intact has affected end-of-life techniques and recovery. Life Cycle Assessment studies show that lightweight and compact packaging helps optimise loading space and reduce transport impact and emissions for the same quantity of goods.

Research and development in recent years has focused on single-material packaging, which is easier to recycle and requires less processing to get back into circulation. Today, 70% of flexible packaging is recyclable, but the crux is the transition from recyclable to recycled. Many plants are designed to dispose of rigid plastics and only sometimes have the technology to separate multilayers. Part of the research is focusing on the production of odourless and colourless recycled polypropylene, and part on research into neo-materials and biodegradable and/or compostable plastics, including composites. The coupling of paper and biodegradable or compostable plastics is becoming increasingly common, particularly for pasta and bakery products. Currently, based on data from the Istituto Italiano Imballaggio, out of 63,000 tonnes of flexible packaging, the component made by coupling biodegradable and/or compostable materials is about 6.5%.

Cutting-edge corrugated cardboard

Corrugated board is a widely consumed material with a long history. Technological innovations over the past decade have expanded its areas of use into unexpected sectors such as interior design and fittings. According to data compiled in 2022 by Grand View Research, the global corrugated board market is worth more than $134 billion, with an expected growth rate between 2023 and 2030 of 6% per year. The spread of e-commerce and the demand for sustainable packaging will drive this growth. On the European market, the numbers are similarly encouraging: 4.8% up driven by food and beverage, in particular by fast-moving consumer goods (FMCG), in other words, products with a fast shelf life due to high demand - as in the case of soft drinks or snacks - or because they are in the fresh area. The corrugated board industry in Italy consists of more than 50 integrated companies and about 300 processors. It is the second largest producing country in Europe, after Germany. The production recorded in 2022 is about 8 billion square metres from 70 plants nationwide. The most significant area is tertiary transport packaging, particularly for the food sector, with 'processed food products' absorbing 60.5% of production. Non-food as a whole - furniture, cosmetics, construction, household appliances, pharmaceuticals, industry, personal hygiene and household cleaning - accounts for the remaining 39.5%. In particular, the pharmaceutical sector is seen as one of the markets that will grow the most in the coming years.

Corrugated board owes its mechanical strength and lightness to its construction. In its simplest form - two layers of flat paper (covers or liners) held together by a layer of corrugated paper (or wave) using natural glue - it has been in continuous use since 1857. With the different arrangement of these elements, various types are obtained. Several layers can be superimposed, double or triple-corrugated, or evenly divided by a stretched sheet for greater strength. Triple-wave board is strong enough to replace wood in some cases but weighs considerably less. The choice of paper also produces a different end product. The most common types are kraft paper (strong, made from virgin conifer pulp with 10%-20% quality recovered pulp), liner and test (papers made from selected recovered pulp and consisting of one or more layers).

The other variable is the type of corrugation applied. The reels of paper are loaded into a corrugating machine, which uses high-pressure steam and pressing to shape them. The waves can have different heights and pitches and vary in the number of waves per linear metre and the corrugation coefficient. The high wave has the best resistance to vertical compression but lower printability because the covers have a reduced flatness; the low wave is more resistant to flat compression, while the medium wave provides a compromise between performance and paper consumption, with good printability and higher resistance to stress during converting, packaging and shipping. The micro wave is mainly used in combination: the most popular format is the mini-triple, which provides excellent printability and is also used in the production of cartons. In addition to the specifications decided at the assembly stage, the board is classified according to its compressive strength, burst strength, water absorption ability and flexibility. Thanks to its versatility and advances in production and printing technology, various types of convertible corrugated packaging are now suitable for transport and product explanation. They are particularly aimed at the retail trade, simplifying loading-unloading and set-up operations with significant time savings.

Flexographic printing (flexo) is the most widely used technique for printing corrugated board. It is a direct printing technique: ink from the tray is deposited directly onto the substrate via the inking cylinder (cliché). The advantages of this technique are its low production cost and high quality. Screen printing is also still widely used, and among its advantages is the possibility of working on large formats, both with spot and 4-colour.

In corrugated board, digital printing has also gained several areas of use. It uses a process to imprint ink onto the substrate without using stencils and plates; with this technique, the ink is not absorbed directly but forms a layer fixed with a finishing. Digital printing allows a high-quality output, and because it does not have the costs of fixed installations, it can be used for short runs. When finishing, it is possible to make the surface of the carton glossy or matt with a lamination process, which is particularly suitable for displays.

One of the most exciting innovations in recent times is the progressive lightening of packaging, made possible by the technological evolution of converting machines and the offering of increasingly high-performance papers. The average weight of corrugated board has fallen steadily since 2000; the average in 2022 is 535 g/sq m. It is estimated to have saved 559,000 tonnes of raw material in 20 years. Also on the production front, research is focused on energy savings, with less energy-intensive processes and machines, and the reduced use of water in the production phase.

On the sustainability front, corrugated board is undoubtedly one of the materials in which substantial progress has already been made, starting with the raw material, which comes almost exclusively from certified forests. Italy is the leading European country in the virtuous management of post-consumer material: according to Comieco's 27th Annual Report of July 2022, 91.4% of paper and cardboard packaging is sent for recovery in our country and 85.1% in the recycling sector. Corrugated cardboard is a material in which recovery has reached significant peaks: 80% of corrugated cardboard for packaging is composed of fibre from pulp.

Folding carton: functional and elegant

In the Italian market, folding carton packaging represents 15% of the cellulose packaging sector. The average turnover of the folding cartons and boxes sector is up +9.9%, with a growth trend over the last ten years higher than the rest of the manufacturing industry, apart from a setback in 2021. It is a counter-cyclical sector, less sensitive to negative cycles.

Production in 2022 is expected to be around 868,000 tonnes. It is predominantly used as secondary packaging, and the target sectors are 44.2% food, 19.2% beverages and 9.2% cosmetics and pharmaceuticals. The remaining 27.3% is grouped under 'non-food' within which are categories such as small household appliances that do not require corrugated packaging, kitchen utensils, household products, furniture accessories, and much more. The cosmetics sector was the most dynamic in 2021, growing by +18.4%, while pharmaceuticals grew by +4.2%. The self-assembling carton is one of the cases where the role of the silent brand ambassador is most versatile and effective. It is a format that moulds itself to the tone of voice of the product: functional, clear and reassuring in pharmaceuticals, refined and aspirational in cosmetics, and engaging and communicative in food and beverage.

The cardboard or folding carton is easy to process, and the different types of surface - coated, matt, embossed, bleached or coloured paste - allow endless graphic and paperboard design possibilities. They can be made of 100 per cent folding carton of different grammages and processes, or composite, depending on the end use. The most common combinations are with PE or aluminium film, which is increasingly replaced by layers subjected to metallisation processes. The combination with a plastic or aluminium film may have functional or aesthetic reasons, such as for packaging used in the cosmetics sector. The strength of cartons is their incredible versatility: matt or glossy printing effects, metallised and textured varnishes for a 3D effect, embossing, and letterpress turn packaging into a sensory experience involving both sight and touch through texture and combinations. The possibility of inserting openings, windows, cuts and half-cuts using die-cutting or laser cutting gives the product greater visibility and variety to the packaging design. The development of laser die-cutting technology has made it possible to integrate this phase inline during printing.

Cardboard is a valuable substrate that lends itself to various aesthetic embellishment techniques without sacrificing functionality through different application lines of lamination with metallic, pastel, glossy/opaque, gold, silver, and hologram effects and through the cold foil or hot stamping process. It is an ideal substrate for gloss and matt screen-printing finishing techniques and glitter and pearlescent UV varnishes.

Printing with high-resolution offset technology that can come into direct contact with products or foodstuffs has also made it a popular type of packaging in the catering industry. With its lower impact on both production and disposal, it is increasingly replacing packaging made of other materials designed to come into contact with food-type products. Also, in the case of cartons, the offering of active packaging that is not limited to the barrier effect is being enriched with advanced functions, such as anti-odour or anti-oxidation layers designed to preserve the integrity of articles better. Among the most popular developments are those relating to coatings and barriers not only to odours but also to grease and moisture. The most exciting innovation is the possibility in recent years to achieve this through cellulose fibre-only barriers (MFC), which significantly facilitates the recycling phase.

Innovation has also involved machinery, which has become more sophisticated over the last few years to be able to process ever-thinner materials in a trend towards lighter paper but with equivalent performance that can optimise costs and environmental impact. Currently, the structural limit of cardboard for product packaging and protection is around 700-800 g/sq m, but this crucial technological advancement has allowed a weight reduction of up to 30%. Improvements in production have been accompanied by continuous research by paper manufacturers to introduce improvements in the choice of additives and the mix between virgin cellulose and waste paper in their range.

The same applies to the varnish and ink sector, with the creation of low-odour and low-migration inks and varnishes and limiting plastic films' use to embellish cartons, boxes and shoppers, replaced by equally high-performance finishing. Using inline cold foil technology in offset printing has made it possible to eliminate metallised plastic films and reduce costs.

A final important innovation concerns safety, with paper solutions with openings designed to prevent an unsupervised child from accidentally opening the carton. These systems are particularly useful in the pharmaceutical and detergent sectors. But the pack finishes are not just aesthetic: embossing allows for 3D effects that make the packaging speak in an accessible way through the use of Braille.

On the sustainability front, all the steps forward in the lightening of the material, in the adoption of finishing and barrier layers that can replace multi-material laminations in many cases have made an essential contribution to reducing the impact of these packaging formats, but another vital feature is the recyclability of the paperboard. Paperboard fibre can be reused up to 25 times, becoming a secondary fibrous material.